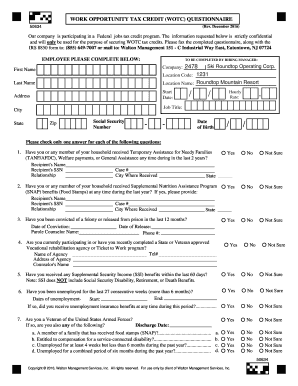

work opportunity tax credit questionnaire social security number

As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit.

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

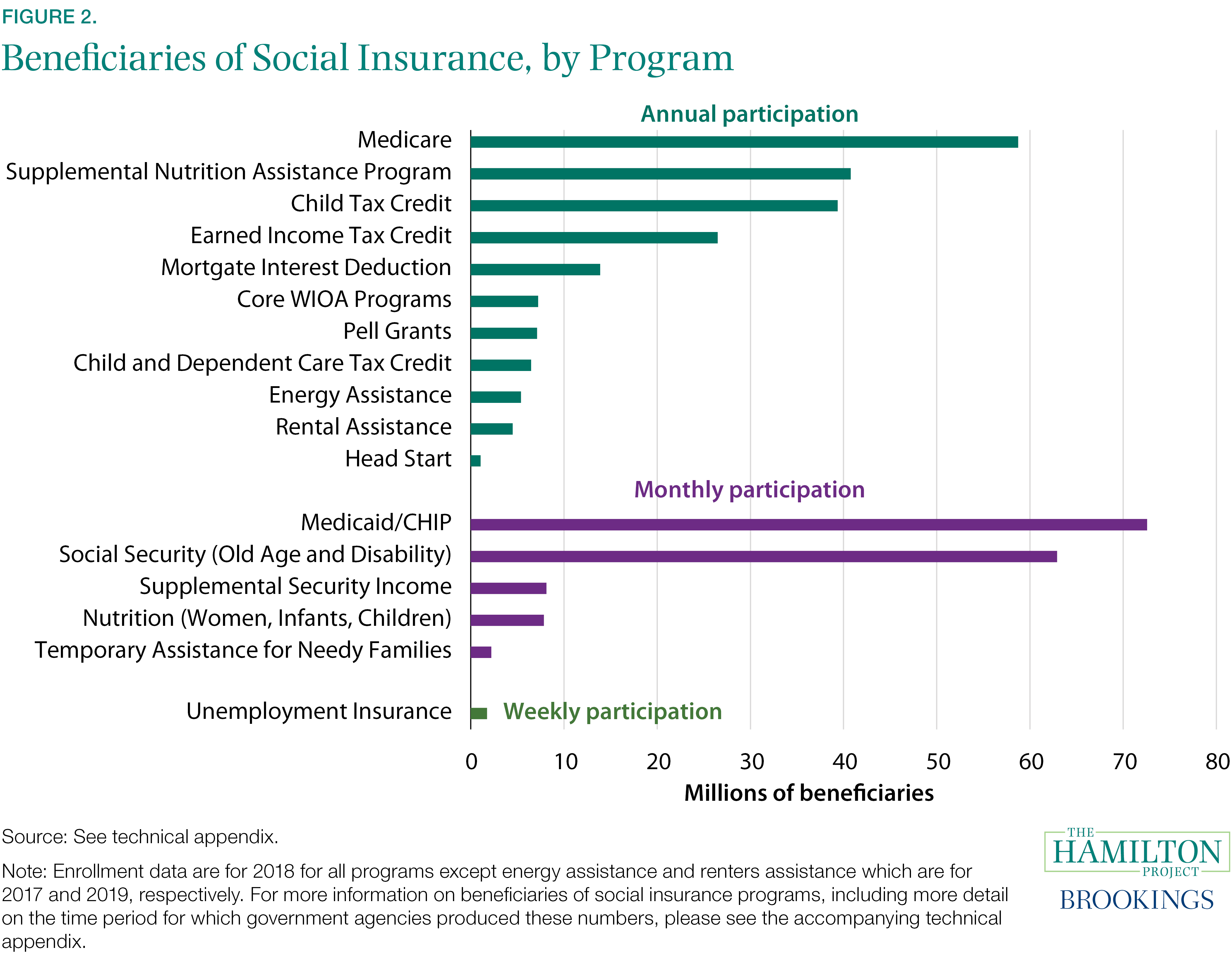

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers.

. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Qualified tax-exempt organizations will claim the credit on Form 5884-C Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans as a credit against the employers share of Social Security tax. Its called WOTC work opportunity tax credits.

There are two sets of frequently asked questions for WOTC customers. The forms require your identifying. Some states prohibit private employers from collecting this.

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. Make sure this is a legitimate company before just giving out your SSN though. I dont feel safe to provide any of those.

Its asking for social security numbers and all. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the. WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment.

Questions and answers about the Work Opportunity Tax Credit program. Work opportunity tax credit questionnaire. The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them.

The Work Opportunity Tax Credit is a voluntary program. April 27 2022 by Erin Forst EA. The credit will not affect the employers Social Security tax liability reported on the organiz See more.

A company hiring these seasonal workers receives a tax credit of 1200 per worker. There are two sets of frequently asked questions for WOTC customers. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP.

I dont think there are any draw backs and Im pretty sure its 100. Work Opportunity Tax Credit. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of.

The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

Asking for the social security number on an application is legal in most states but it is an extremely bad practice.

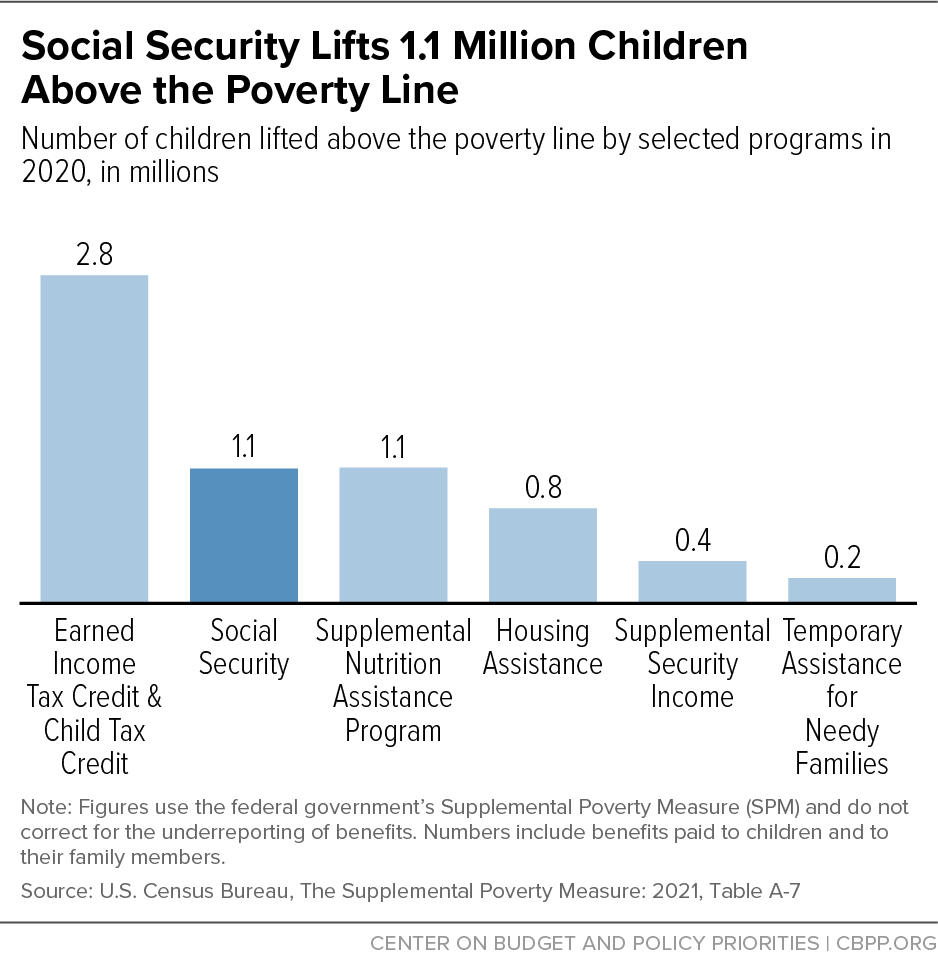

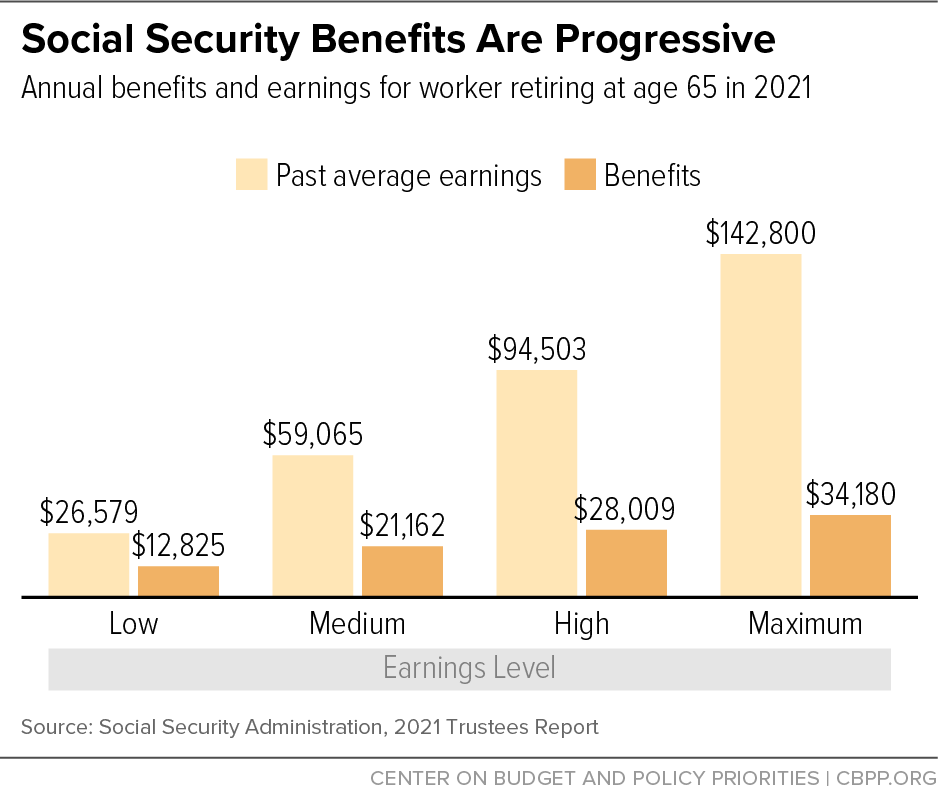

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Federal Wotc And Local Tax Credit Assistance Maximus Tces

Social Security United States Wikipedia

Benefit Rights Information For Claimants And Employers

Work Opportunity Tax Credit R D Other Incentives Adp

Social Security Numbers Taxes Career Training Usa Interexchange

Should You Add Your Social Security Number On A Job Application What Are Some Alternatives Choices To Take Quora

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

6 Benefits Of Filing Your Taxes Early Ramsey

Work Opportunity Tax Credits Redfworkshop

Wotc Questions Are Employees Required To Fill Out Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

A Comprehensive Guide To 2022 Tax Credits Smartasset

Edocument Equifax Edoc Avionte Classic

12 Commonly Asked Questions On The Employee Retention Credit Sikich Llp

Wotc Form Rt Employee Forms Fill And Sign Printable Template Online

Asking For Social Security Numbers On Job Applications Goodhire

When An Employer Can And Can T Ask For A Social Security Number Inc Com

Social Security Update Archive Ssa

Should You Add Your Social Security Number On A Job Application What Are Some Alternatives Choices To Take Quora